TORONTO, June 2, 2014 – Desert Gold Ventures Inc. (TSX-V: DAU) (the "Company" or "Desert Gold") is pleased to record extensive metallurgical test work conducted on bulk mining samples from the recently drilled and sampled Barani East Gold Deposit (the “Deposit”) indicates gold recoveries up to 85%. The company is currently engaged in a feasibility study to support fundraising for the development of a mine on the deposit.

Process Design

A two ton bulk sample of ore collected from the Barani east prospect was submitted to Peacocke Simpson & Associates (Pty) Ltd’s minerals processing laboratory in Harare, Zimbabwe for bulk metallurgical work.

The company has commissioned an engineering design team from Appropriate Process Technologies (Pty) Ltd (Johannesburg, South Africa) (“APT”) for plant design. APT specialises in the manufacturing of modular mineral processing plants and are designing a plant to optimise the economic exploitation of the resource. The latest tests indicate that a low capital cost plant comprising a wash and screen (2 mm) circuit, with minor crushing, feeding to a Knelson gravity concentrator will recover 40.3% of the gold. The tailings from the Knelson concentrator were fed to a Knelson continuous variable discharge concentrator (CVD) from which concentrates with a mass yield of approximately 11% were subjected to a cyanide leach, which resulted in an additional 25% of the gold to be recovered. Although this process, in aggregate, generates a lower recovery of the gold (65%) compared to other processing alternatives, this configuration requires the least capital investment, being some 80% cheaper than the alternative maximum recovery design plan, and having the lowest operating costs. Tailings with the unrecovered gold will be stockpiled as an asset for later re-treatment.

About the Project

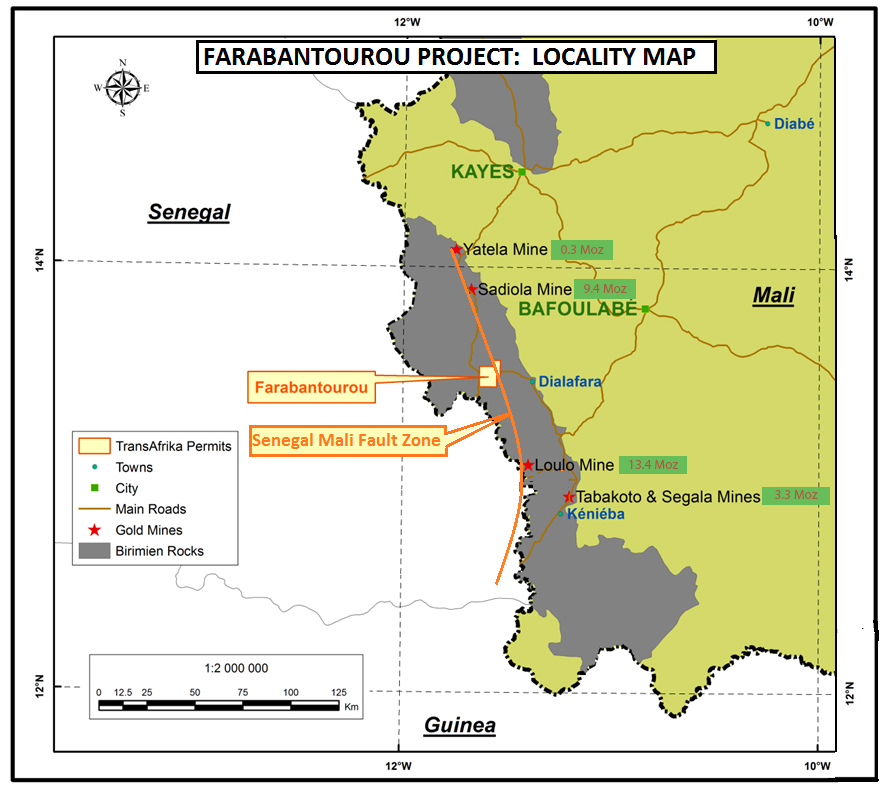

The Barani East Gold Deposit occurs on the Desert Gold’s Farabantourou Permit located in Western Mali. The permit falls on the Senegal-Mali Fault Zone (“SMFZ”), 40km south of Sadiola Mine and 50km north of the Loulou-Gounkoto mine complex (Fig. 1). Both these mines are on the SMFZ.

Figure 1. Locality map of the Farabantourou project in relation to the SMFZ and the major producing gold mines in Western Mali. The global resources for the mines are noted alongside their names.

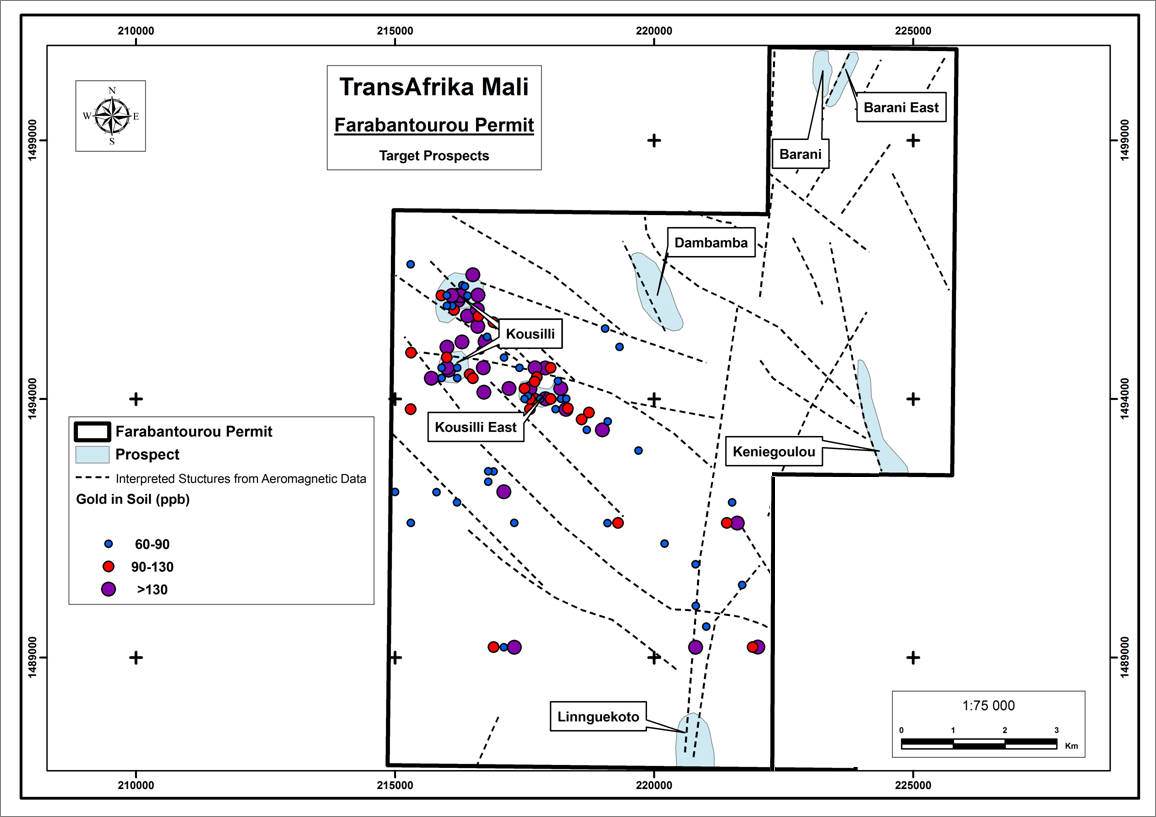

Barani East is the first of 6 prospects with proven gold mineralization expected to be developed by Desert Gold on the permit. The project has been drilled to a depth of 120m with mineralization open to depth in the southern part of the deposit (Fig. 2).

Figure 2. Locality plan of the gold mineralised prospects within the Farabantourou exploration permit (light blue zones). The distribution of coloured dots reflect anomalous Au in soil geochemical results ( magenta >130 ppb).

The Resource

The company has focused drilling on the Barani East prospect and has completed a maiden mineral resource estimate, which indicates a total of 108,100 oz gold in the indicated and inferred categories with average grades of 2.50 g/t gold at a cut-off value of 1.0 g/t gold. (Table 1). This resource is currently defined to a maximum depth of 120 m below surface over a strike length of 400m. The deposit is tabular, mineralisation varying in thickness from 4.5m to 15m, and dipping to the east between 45o and 60o. The gold mineralisation is associated with quartz hematite rocks and kaolinite veins within siltstone and shale.

| Resource Category | Tonnes | Grade (g/t Au) | Ounces Au |

| Indicated | 514,000 | 2.46 | 40,600 |

| Inferred | 828,000 | 2.53 | 67,500 |

| TOTAL | 1,342,000 | 2.50 | 108,100 |

At a cut-off grade of 1 g/t

Table 1. Barani East estimated mineral resource (April 2013).

Farabantourou Strategy

Desert Gold’s Farabantourou permit strategy is to develop the other 5 known gold prospects to a mineral resource definition stage similar to what has been achieved at Barani East. Funding for drilling on the other 5 prospects will be provided out of mining revenue from a low cost opencast mining operation on Barani East. A feasibility study is being concluded to define the CAPEX and related operational cost associated with a potential mining operation to extract the resource as defined from surface. High grade Au intersections of 9.99g/t over 4m and 8.60g/t over 3.5m at 120m vertical depth show potential for developing an underground resource at Barani East following the exploitation of the open pit resource.

About Desert Gold

Desert Gold Ventures Inc. is an advanced exploration and development company which holds mining assets in Mali and Rwanda.

For further information concerning Desert Gold Ventures Inc. and the TransAfrika material properties, please refer to Desert Gold's SEDAR profile at www.sedar.com or visit our website at www.desertgold.ca.

This announcement has been reviewed by Mr. Mark Austin, Senior Partner of Applied Geology & Mining Pty Ltd, who has more than 30 years of relevant experience in the field of activity concerned. He is a fellow of the Geological Society of South Africa ('GSSA') and is registered as a Professional Natural Scientist with the South African Council for Natural Scientific Professions (No. 400235/06) and he has consented to the inclusion of the material in the form and context in which it appears.

This news release has been prepared on behalf of the board of directors of Desert Gold, which accepts full responsibility for its contents.